You’ve probably asked yourself lately: Is it even worth trying to buy a home right...

Rent vs. Buy

A study shows 70% of prospective buyers fear the long-term consequences of renting. And here’s...

It feels like everything is getting more expensive these...

If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of...

Trying to decide between renting or buying a...

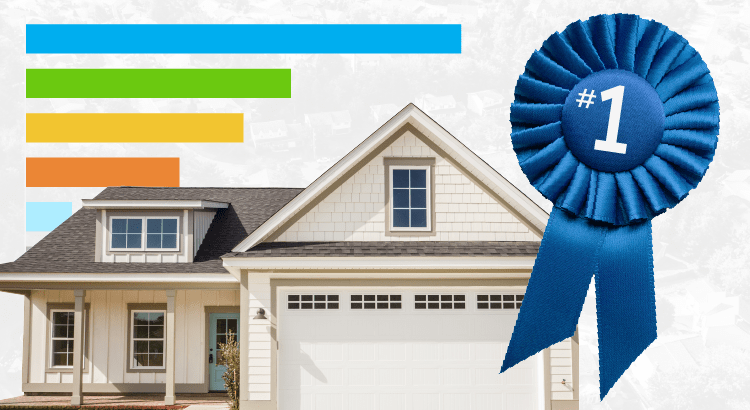

Some HighlightsBased on a recent study, in 22 of the top 50 metros, the monthly mortgage payment is lower than the rent payment.Make sure you work with a pro who can help you crunch the numbers and see how your city stacks up. This may be your opportunity to forget renting for good. If you want to see which option makes the most sense in your area, connect with a local...

Figuring out what to do with your house when you're ready to move can be a big decision. Should you sell it and use the money for your next adventure, or keep it as a rental to build long-term wealth?It's a question many homeowners face, and the answer isn't always straightforward. Whether you're curious about the potential income from renting or worried about the responsibilities of being a landlord,...

Some HighlightsAccording to a recent poll from Gallup, real estate has been voted the best long-term investment for twelve straight years.That’s because a home is so much more just than a roof over your head. It’s also an asset that typically grows in value over time. If you’ve been debating if it makes more sense to rent or buy, connect with a real estate agent to talk about why homeownership can...

Some HighlightsWhile renting may be less expensive in some areas right now, there are two big benefits homeownership provides that renting can’t. Owning a home means you get to say goodbye to rising rents and hello to stability. It also gives you the chance to gain equity as home values rise over time. If you’re ready to learn more about the perks of owning a home, connect with a local real estate...

Thinking about buying a home? While today’s mortgage rates might seem a bit intimidating, here are two solid reasons why, if you’re ready and able, it could still be a smart move to get your own place.1. Home Values Typically Go Up Over TimeThere’s been some confusion over the past year or so about which way home prices are headed. Make no mistake, nationally they’re still going up. In fact, over...